Contact Us

Let's Get in

Touch

Email Address

hello@dnl.ae

Call Us

+971 45833365

Address

DNL Properties - Sales Boutique

Retail G07, Bay Square - Building 8,

Business Bay

P O Box 242409 - Dubai, UAE

A password will be e-mailed to you

DUBAI

Dubai’s real estate market is experiencing rapid growth and transformation. With its booming economy, strategic urban developments, and a strong appetite for luxury living, the city continues to attract global investors. In 2024, the market shows robust growth, evidenced by a remarkable 19.9% increase in property values last year.

Key factors influencing the market include rising demand across residential, commercial, and industrial sectors, paired with favorable regulatory frameworks. As of December 2024, property transactions surged by 38% compared to 2023, with price increases across apartments, villas, and commercial properties.

Looking ahead, Dubai’s market is projected to continue expanding, with a projected Compound Annual Growth Rate (CAGR) of 8% between 2024 and 2029. Investors can expect strong returns, especially in luxury real estate and office space developments. The future of Dubai’s real estate market is promising, with significant opportunities in both high-end and affordable housing segments.

DUBAI

The demand for residential properties is soaring, particularly in prime locations like Downtown Dubai and Palm Jumeirah. Villa prices have surged by 20%, as high-net-worth individuals and families prefer spacious homes. Regulatory incentives like long-term visas for foreign investors continue to fuel market growth.

The commercial sector is also rebounding, with rising demand for Grade A office spaces in areas like Business Bay and DIFC. Retail spaces are thriving due to increased tourism and consumer spending, creating new opportunities for investors.

Dubai’s ongoing infrastructure projects, including the expansion of the Dubai Metro and new transportation networks, are enhancing connectivity and making new areas attractive for property investment. Key projects like Dubai Creek Harbour and Expo 2020 legacy developments are expected to drive demand.

Dubai’s luxury real estate market is seeing unprecedented growth, with high demand for exclusive properties in areas like Palm Jumeirah and Emirates Hills. The city’s status as a luxury hub attracts ultra-high-net-worth individuals seeking privacy and high returns on investment.

Property prices in Dubai are expected to rise by 7-9% annually over the next five years. The market remains resilient, with continued growth in residential, commercial, and luxury sectors.

DUBAI

In December 2024, Dubai’s real estate market continued its impressive upward trajectory, reflecting the strong performance sustained throughout the year.

December 2024 saw a total of 20,500 property transactions, marking a 6.8% increase compared to November 2024 and a significant 38% rise compared to December 2023.

The average price per square foot reached AED 1,580, reflecting a 1.3% month-over-month growth and a 9% increase year-over-year.

The total sales value for the month amounted to AED 50 billion, up by 5.9% from November 2024 and 22% higher than in December 2023.

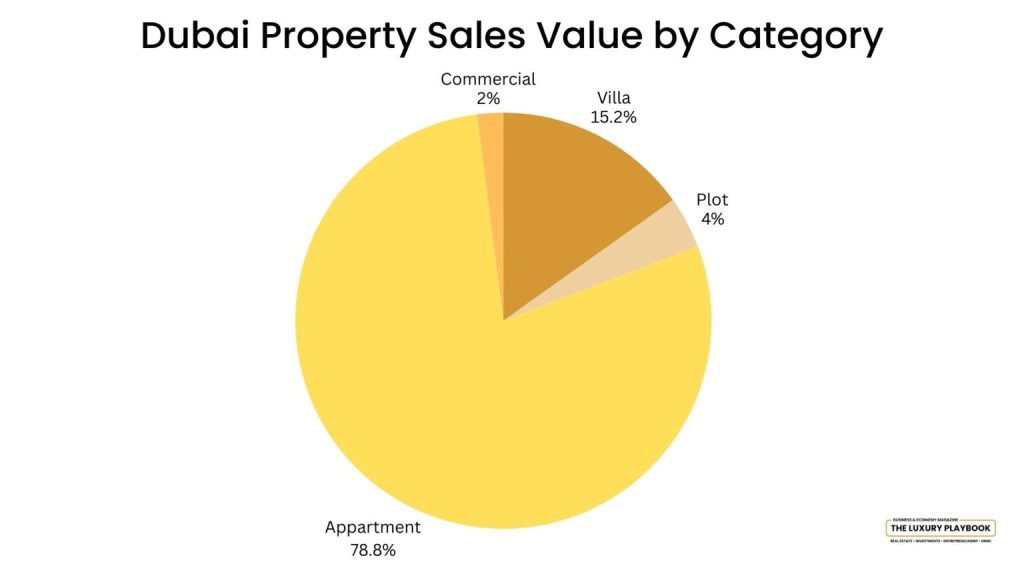

Apartments: There were 16,200 apartment transactions, a 6.5% increase from November 2024, with a total sales value of AED 28 billion. The average price for an apartment increased to AED 1.4 million, a 3.7% rise from the previous month.

Villas: The villa sector recorded 3,200 transactions, a 2.5% increase from November 2024, contributing AED 14 billion in total sales. The average villa price rose to AED 3.1 million, marking a 3.3% growth compared to the previous month

Commercial Properties: There were 450 commercial property transactions, a 12% increase from November 2024, generating AED 950 million in sales. The average price for commercial properties increased to AED 1.65 million, reflecting a 6.5% rise from the month before.

Plots of Land: The land market recorded 850 transactions, showing a notable 34.5% increase from November 2024, with sales totaling AED 7.8 billion. The average price per plot increased to AED 5.6 million, a 1.8% growth from the prior month.

DUBAI

Apartments: The average price for an apartment reached AED 1.4 million, showing a 3.7% increase from November 2024 and a 9% rise from December 2023. This increase is attributed to sustained demand, particularly in high-demand locations.

Villas: The average villa price climbed to AED 3.1 million, marking a 3.3% rise from November 2024 and a 10% year-over-year increase. This trend highlights a continued preference for larger living spaces, especially among families.

Commercial Properties: The average price of commercial properties surged to AED 1.65 million, reflecting a 6.5% month-over-month increase and a significant 38% year-over-year growth. This uptick suggests a strong demand for premium office spaces and high-end commercial properties.

Plots of Land: Land prices saw strong appreciation, with the average price rising to AED 5.6 million. This represents a 1.8% increase from November 2024 and a 9.5% growth year-over-year. The ongoing demand for land, particularly in key locations, aligns with Dubai’s ambitious growth plans.

In October 2024, Dubai’s rental market exhibited key trends across property types:

Apartments: The average annual rent for apartments rose to AED 86,000, marking a 2.4% increase from November 2024 and a 20% rise compared to the previous year. This growth is indicative of continued demand, particularly from expatriates and short-term renters.

Villas: The average annual rent for villas reached AED 190,000, reflecting a 2.7% increase month-over-month and a 6% rise year-over-year. This suggests sustained interest in larger homes, especially in suburban and upscale districts.

Commercial Properties: The average annual rent for commercial properties climbed to AED 69,000, a 2.3% increase from November 2024 and a 22% year-over-year growth. This surge points to strong demand for commercial spaces, especially in business hubs throughout Dubai.

These trends underscore the dynamic nature of Dubai’s rental market, with varying levels of demand across different property segments.

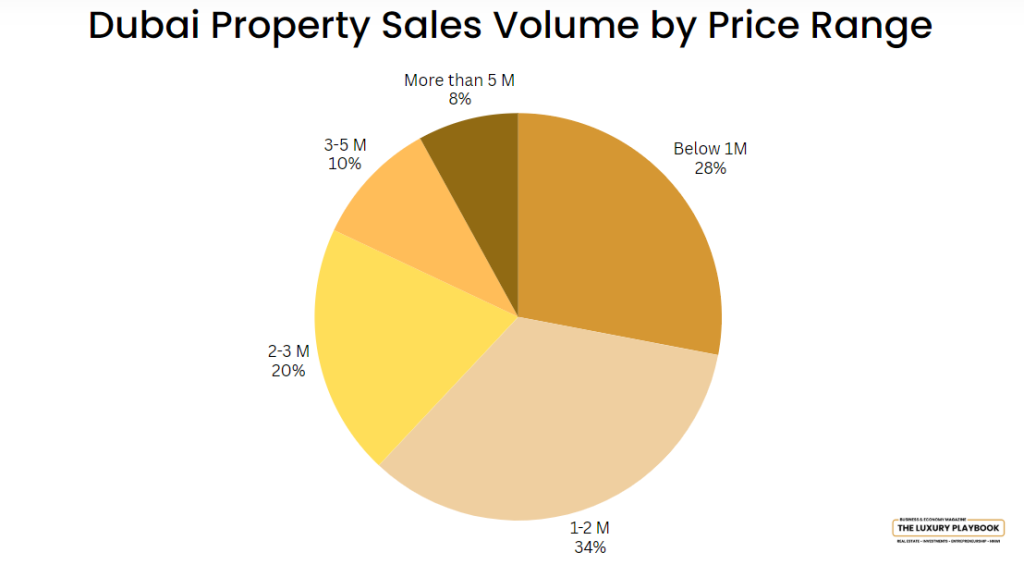

In December 2024, the Dubai real estate market saw a wide distribution of sales across various price ranges, demonstrating the city’s appeal to diverse buyers:

Dubai Property Sales Volume by Price Range by The Luxury Playbook

Analyzing the monthly sales volume for 2024 reveals a consistent upward trajectory in Dubai’s real estate market. The year commenced with 11,000 transactions in January, gradually increasing to 12,500 in February and 13,800 in March.

April saw a slight dip to 13,200 transactions, followed by a significant surge in May, reaching 18,000 transactions—the highest for the year at that point.

The momentum continued into the second half of the year, with June recording 17,500 transactions and July experiencing a seasonal slowdown to 16,000 transactions. August rebounded to 17,200 transactions, and September matched May’s peak with 18,000 transactions, indicating a strong finish to Q3 2024.

December surpassed previous months, achieving a record 20,700 transactions, reflecting sustained investor interest and confidence in Dubai’s real estate market.

This consistent growth throughout 2024 underscores the Dubai property market’s resilience and attractiveness to both local and international investors.

Looking at property sales volume over the years, the data clearly shows a substantial rise in transactions. Sales have grown from under 3,000 in 2014 to nearly 21,000 in December 2024, reflecting Dubai’s sustained growth as a global real estate hub.

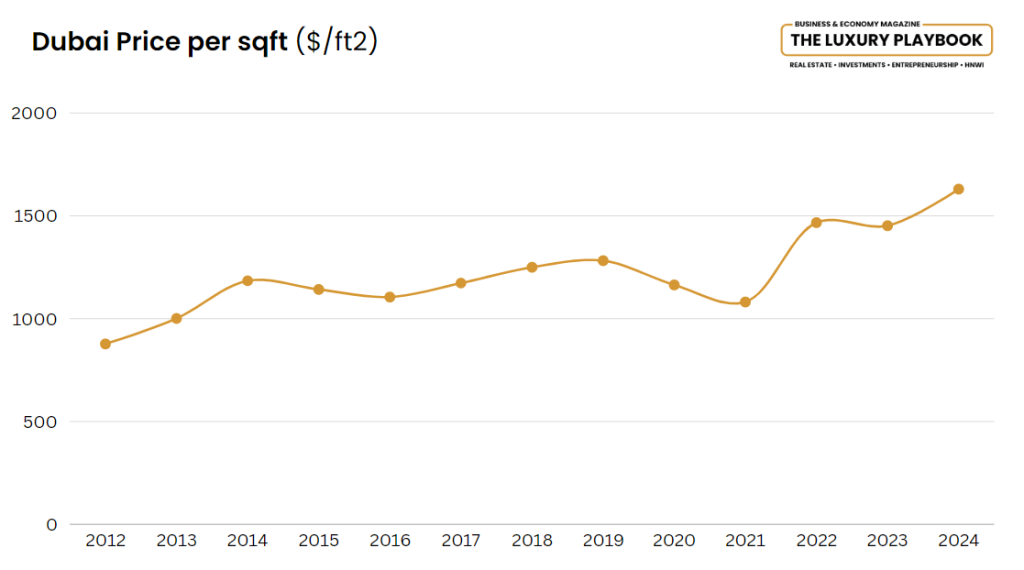

In terms of price per square foot, the market has experienced steady growth since 2020. From a low of AED 865 per sqft in 2018, the average price per sqft reached AED 1,539 in December 2024, demonstrating a strong recovery and continued upward momentum in property values.

Dubai’s real estate market is renowned for its resilience and adaptability. Despite facing occasional fluctuations, the city consistently attracts both investors and homebuyers from across the globe. Understanding the key indicators that contribute to the market’s sustained growth is essential for recognizing its stability.

One of the most important signs of Dubai’s market resilience is the stability in property prices. Over the years, despite minor dips, property values in Dubai have generally experienced steady appreciation. This consistent growth makes the city a highly attractive destination for property investment, as investors can rely on long-term gains.

In 2024, Dubai’s real estate market exhibited strong growth and resilience. In the first half of the year, the market recorded over 75,543 residential transactions, valued at AED 191 billion, reflecting a 36% increase in transactions year-over-year and a 17% rise compared to the second half of the previous year.

In Q3 2024, Dubai’s real estate market reached new heights, with a record-breaking 50,425 transactions—the highest ever recorded in a single quarter. These transactions generated a total sales value of AED 141.95 billion, marking a 30% rise from the same quarter in 2023.

A major driver behind this growth has been the luxury real estate market. In the first half of 2024, sales of properties exceeding AED 10 million increased by an impressive 47% compared to the same period in the previous year. This surge demonstrates Dubai’s position as a global hub for high-net-worth individuals seeking luxurious, exclusive properties.

Several factors contribute to the ongoing strength of Dubai’s real estate sector:

hello@dnl.ae

+971 45833365

DNL Properties - Sales Boutique

Retail G07, Bay Square - Building 8,

Business Bay

P O Box 242409 - Dubai, UAE

A password will be e-mailed to you

Use the form below to contact us!